What Interest Rate Can I Really Expect on a Home Loan?

Advertised mortgage rates often sound very attractive. Sometimes they sound too good to be true. For many people, they are. The annual percentage rate (APR) you will be quoted for a 30-year fixed-rate mortgage by a bank or other lending institution will depend on several factors, including your income, the amount of the loan compared to the value of the home, and your credit score (see 7 factors below).

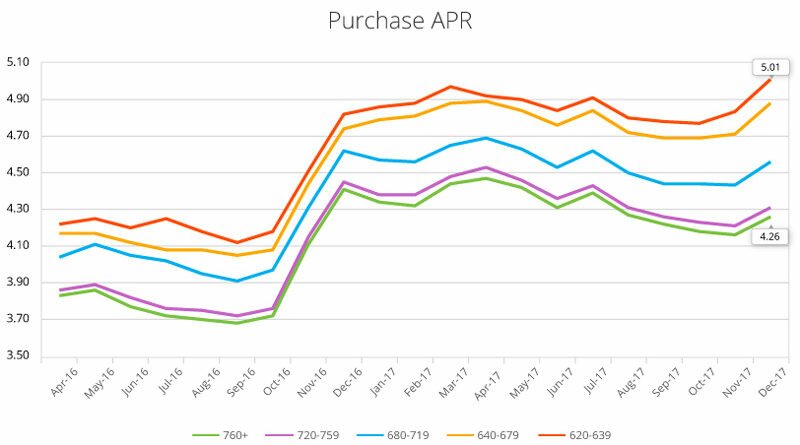

To give an idea of what kind of rate you can really expect, Lending Tree compared the actual average mortgage rates (APR) to borrower’s credit scores.

While the best borrowers—those who ticked off all the check boxes glowingly—had an average APR of 3.80 percent in December 2017, the average among those with very good credit scores—760 or higher—was 4.26 percent. That means even people with high credit scores don’t always get the best possible rates, due to the other factors.

These difference matter, of course. Those with credit scores of 680-719 got an average loan rate of 4.56 percent in December 2017, which over 30 years on a $233,586 loan (the average amount in the U.S.) would mean an additional $15,000 in costs compared those with credit scores of 760 or higher, Lending Tree calculates.

Those with credit scores below 640 saw an average rate of 5.01 percent.

Again, keep in mind this graph shows average results. Your mileage may vary, depending on your income or any of the other factors that go into calculating a lender’s risk. And while you may be reading this well after the analysis was done, the concept remains the same.

Factors That Affect Mortgage Rates

In addition to credit score and income, here are important factors that figure in to the rate you’ll be quoted, according to Lending Tree and the Consumer Financial Protection Bureau.

- The home’s location (including which state it’s in)

- Loan amount compared to appraised home value

- Loan type (such as conventional versus FHA or VA)

- Loan terms (such as 15-year vs. 30 year)

- Interest rate type (fixed vs. adjustable)

For more information and an online loan calculator, check with the Consumer Financial Protection Bureau, a federal agency.